2021 is a big year for open banking, thanks to a landmark announcement in the US this summer.

Dima Kats, CEO of Clear Junction, explains what open banking is and why businesses should care.

Open banking breaks down traditional barriers in the financial sector that kept customer data locked up. For years, the only way businesses and consumers could view financial data like transaction histories was through paper statements or web forms. The lucky ones may have been able to access data in PDFs, or perhaps as downloadable files for specific desktop programs. For most customers though, that put restrictions on how they could use that data. Open banking changed everything. It puts businesses and consumers back in control of their data, allowing them to grant direct access to third-party companies via application programming interfaces (APIs) operated by their banks.

Open banking needs data

Data access is important for fintech companies that want to enhance their own services, such as fast loan approvals or budgeting applications. An online budgeting service could use customers' transaction data to show them summaries of where they spend their money, helping them to plan their finances more effectively. Fintech also includes elements of artificial intelligence (AI), typically in the form of machine learning. The combination of access to larger amounts of financial data and the power of AI will enable businesses and consumers to glean new insights from banking services.

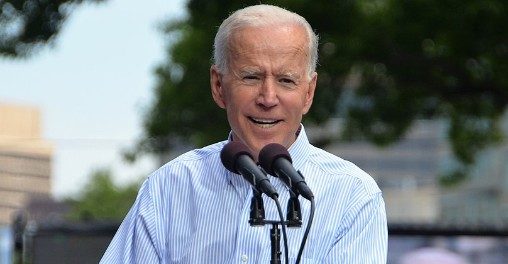

Initial access to that data has been difficult in the US, but on 9 July 2021, the Biden administration took a big step to support open banking's quest for data by introducing an Executive Order on Promoting Competition in the American Economy. The Order contained a series of measures covering issues ranging from the right to repair through to non-compete clauses. Among them was a request for the Consumer Financial Protection Bureau (CFPB) to consider new rules that would mandate portability for financial data. This move didn't happen in a vacuum. The CFPB had already issued non-binding guidance on open banking in 2017, followed by an advanced notice of proposed rulemaking last October that would give open banking principles regulatory teeth. Nevertheless, the Executive Order brings even more momentum to this issue.

Embracing competition

Hard rules on data portability will have a significant impact on a US banking market that has seen an erosion of competition in the last few decades, with nine in ten banks closing since 1985. Gaining access to their data will give consumers and businesses more power to switch financial institutions. It will also spark a whole new wave of innovative competition. Smaller challenger banks in the US will be able to offer services using customers’ banking data.

Ushering in a new era of open banking in the US will also encourage cooperative relationships between incumbent and new financial players. Soon, consumers and businesses will be able to make their financial data available to fintech players who can use it to offer cutting-edge services at speed and scale, often in partnership with incumbent banks or with each other. Fintech companies will be able to use APIs to exchange data with banks directly so that they can complement each others' services and provide seamless user experiences.

The Executive Order was also a clear sign that this administration wants to keep laws and regulations in sync with new technological developments. This is encouraging, as it gives more certainty to new and rapidly evolving areas of the economy. Clear rules stipulating data sharing will encourage fintech companies to invest in more exciting services.

Spreading open banking through responsible regulation

This development in the US will hopefully also stimulate competition abroad, where open banking concepts are in various stages of development. In Europe, version 2 of the Payment Services Directive (PSD2) took effect in 2018, imposing similar data portability rules. The results have been impressive. In the UK, 2.5 million UK consumers and businesses now use open banking-enabled products to handle their finances, according to the UK government's Competition and Markets Authority.

With the call for open banking now coming from the highest levels of leadership in the US, it's time other countries around the world align themselves with similar regulations that will encourage competition and partnerships in the financial sector. This will boost the customer experience with new and innovative services. It takes joined-up thinking to create a new era of joined-up services.