Looking for investment tips? Each week we look at several companies who show the potential to bring in big returns on the stock market from our in-house experts.

As the stock markets fluctuate and countries head into recession, we're starting a series looking at the stocks with the most potential for good returns with analysis and expert from the Finance Monthly team. This week, we're looking at Countryside Properties and Royal Dutch Shell:

Countryside Properties

Covid-19 has severely hit the housing market in the UK and this morning FTSE 250 company Countryside Properties PLC (CSP) reported that it lost completions and land sales in March which has impacted profit by £29 M and increased debt by £83 M. As of writing the share price had dropped 10% at the opening. With the housing market key to any economic recovery I would expect to see developers to do much better in the coming months as the lockdown is eased.

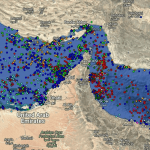

Royal Dutch Shell

With the world’s economies grinding to a halt oil prices have hit new lows in recent weeks. Royal Dutch Shell Plc (RDSA: LON) has seen its share price drop by over 52% from its 12 month high but there is no doubt that oil will be in great demand once the economic recovery finally gets underway. It seems to me that the world’s biggest players in the energy/petrochemical sector have enough in reserve to weather the storm and Shell, in my opinion, did the right thing but cutting its dividend – the first cut since WWII. No doubt it will be a bumpy ride ahead, but Shell stock looks like good value as things stand.

Please invest responsibly. Views expressed on the companies mentioned in this article are those of the writer and any investment undertaken should be independently investigated by the investor. Finance Monthly accepts no responsibility for any investment. For more information visit our stock disclaimer