Why Social Media Analytics is an Essential Component of Due Diligence

Public Sentiment Has Power:

Why Social Media Analytics is an Essential Component of Due Diligence

Lisa Dane - Vice President, Charles River Associates

In the era of ESG and socially responsible investing, the ubiquity and virality of social media holds sway over businesses. Simply being profitable is no longer good enough, profitability must be achieved in a way that the general public agrees with. On paper, the financials of a target company could be impressive, the backgrounds of key executives could be squeaky clean. But before you breathe a sigh of relief and follow through with the investment, you must examine the most “public” of all public records—social media.

One controversial post, regardless of intent or accuracy, can circle the globe in an instant, and profoundly affect the business and its leadership.

The sheer volume of social media posts on countless topics and platforms makes analysing that sphere in a due diligence context a daunting prospect. However, sophisticated social media analytics tools allow for targeted research; information can be efficiently gathered across multiple social media platforms to identify and measure what people are saying about a company or its management, who is saying it, and how it resonates.

Robust due diligence in an M&A transaction should encompass a two-pronged approach to social media that focuses on what is being said about a business entity and its management, as well what the business and management are posting themselves.

Understanding the target company from the public’s point of view

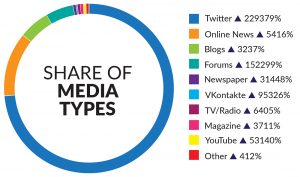

Tools allow us to conduct “topic queries”. Those queries can be as simple as the name of the target company for any mentions of the entity or can include key words that allow the analyst to zoom in on commentary relating to a particular issue using terms such as “mismanagement” or “scam” or “accounting scandal”. The output includes graphics (see sample below), that reveal the total volume of the conversation over a period of time and on what platforms the conversation is happening (e.g., Twitter or Reddit).

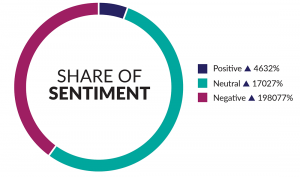

The results can also be visualised by sentiment based on positive, negative or neutral coding.

As seen in the graph above, the software can show spikes in the conversation, which is a stark reminder of how quickly commentary can go viral. The next step is to investigate who is commenting: is it a competitor, a former employee with a grudge, a short seller, an environmental activist? Understanding the drivers of the conversation, and who is driving them can help investors refine their investment thesis and strategy.

Understanding the executives

As we all know, businesses are the people who run them. The social media aspect of due diligence gets you closer to understanding what makes the people of a particular company tick. It’s a window into what they believe, what they feel, and who and what is important to them.

In addition to conducting topic queries on the target company’s management to learn what the public may be saying about them, it’s necessary to determine whether the individuals themselves are posting content that may be relevant to your decision-making.

In the current global political and social environment, the public is on perpetual high alert. So, the CEO posting about a hunting vacation with friends, or the VP who endorses a politician known to have posted disparaging racial remarks can spark a social media frenzy that can alter a company’s value within days. It doesn’t matter at that point how great the target company’s product is if the public has decided they don’t want to buy “x” from someone who thinks “y.”

The other aspect of an executive’s social media profile that may prove relevant is who they are connected to. An executive’s connections may include people who are cause for consideration such as government officials or people at a competitor firm. Some connections could be more problematic: for example, the executive may be tied to individuals or groups espousing controversial views. Although the executive may not hold the same beliefs, the “guilty by association” factor comes into play. If a clever journalist could uncover the same connection, your prospective investment may be in peril.

Investors have a duty to their clients to ensure that their due diligence is as thorough as possible. More information is always better than less, especially if there is a simplified way to gather and measure it using analytical tools. Unlike financial or other company records, social media can be thought of as an evolving “record” of information which can drive sentiment in one direction, or another, affecting a company’s reputation and, in turn, its financial performance. Unlike traditional media, social media doesn’t have to be accurate or even remotely grounded in reality, but that public sentiment has power. It moves money.

While it is unlikely that an investment decision will ever hinge entirely on social media posts by or about an executive or the target company, using tools to efficiently distil meaningful intelligence from voluminous social data can complement and bolster traditional due diligence methods. Most importantly, it can give you a higher degree of confidence in the success of your investments.

Lisa Dane is Vice President with Charles River Associates. The views expressed herein are the views and opinions of the author and do not reflect or represent the views of Charles River Associates or any of the organizations with which the author is affiliated.